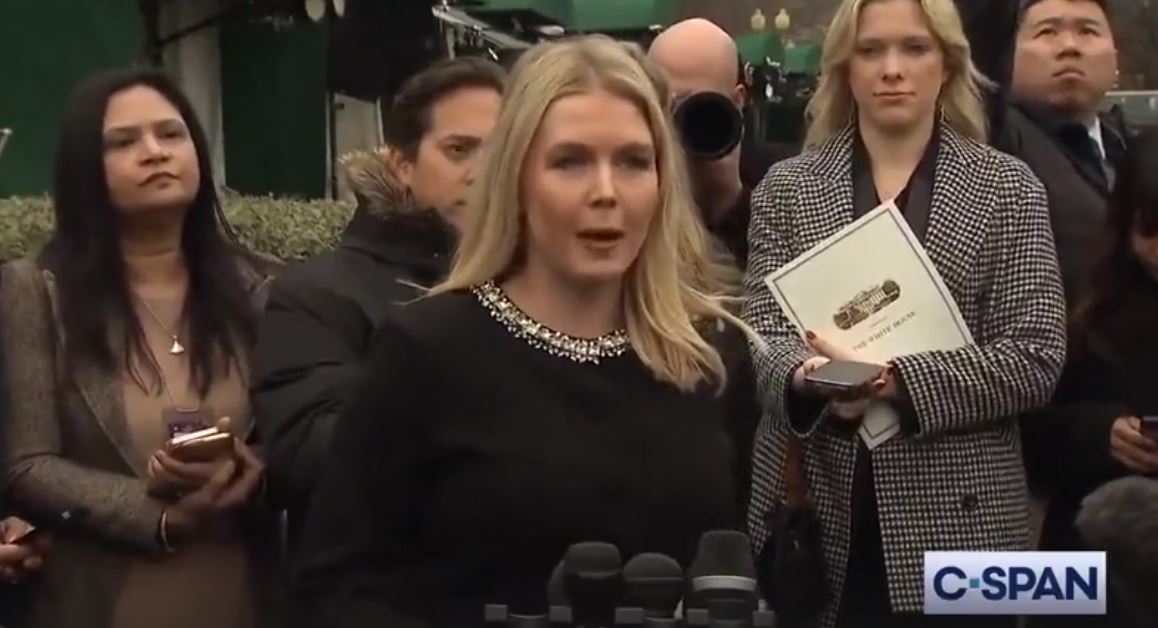

White House Press Secretary Karoline Leavitt outlined President Donald Trump’s latest tax plan in a press briefing Tuesday. The plan includes sweeping tax cuts for middle-class Americans and targets loopholes used by billionaire sports team owners and Wall Street executives.

“These are the tax priorities of the Trump administration that the president has laid out for members in that meeting today,” Leavitt said. At the center of Trump’s tax agenda is the elimination of taxes on tips, Social Security benefits for seniors, and overtime pay—three key promises he made on the campaign trail.

In addition, Trump is seeking to renew his 2017 middle-class tax cuts while making adjustments to the state and local tax (SALT) cap, an issue that has sparked debate in high-tax blue states. Perhaps most notably, Trump’s plan closes the carried interest loophole, a tax break often exploited by hedge fund managers, and eliminates special tax deductions for billionaire sports team owners.

“These tax cuts will be the largest in history for middle-class working Americans,” Leavitt emphasized. “The President is committed to working with Congress to get this done.”

WATCH:

President Trump and congressional Republicans are pushing ahead with ambitious plans for extensive tax reforms. Central to their agenda is the extension of the individual tax cuts introduced under the 2017 Tax Cuts and Jobs Act (TCJA), set to expire at the end of the year.

These cuts, if extended, are projected to increase the federal deficit by about $4 trillion over the next decade. The announcement comes as Trump prepares for another showdown with Democrats in Congress, who are likely to push back on aspects of the plan, particularly those affecting state-level deductions and corporate tax structures.

Beyond extending the existing cuts, the administration also proposes fresh reductions. Notable among these is the elimination of federal taxes on tips, overtime pay, and Social Security benefits—a move designed to boost the take-home earnings of workers and retirees.

Additionally, the administration seeks to lower the corporate tax rate to 15% for domestic production, aiming to bolster domestic manufacturing and investment. These proposals, however, are causing rifts within the Republican Party.

While the administration advocates for making the tax cuts permanent, some House Republicans are wary of the long-term fiscal impact and suggest a more cautious five-year extension. Financing these tax cuts poses a significant challenge. Some legislators are calling for cuts in government spending, which could include trimming programs like Medicaid to offset the loss of tax revenue.

Others are concerned about the potential escalation of the national debt. The strategy is intended to generate additional revenue and safeguard American industries.

President Trump met with congressional Republicans on Thursday to discuss a comprehensive bill aimed at reducing taxes, regulations, and government spending, according to The Associated Press. House Speaker Mike Johnson (R-LA) aims to secure passage in the House by April, but challenges persist due to internal conflicts and the party’s narrow majority.

With an economy still recovering from Biden-era inflation and regulatory overreach, Trump is making it clear he wants to put money back in the pockets of working Americans. Whether Congress cooperates remains to be seen.